Corinthian students demand that the government discharge the student loans for their 'useless' degrees

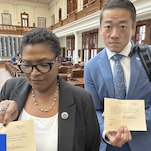

On Tuesday, more than a dozen former Corinthian College students demanded that the government discharge the debt they incurred during their time at the troubled for-profit college.

“Discharge these loans,” Nathan Hornes, 25, said. “You’ve been investigating this company for several years…do the right thing.”

Corinthian, the former students said, pressured them into taking out loans and then failed to teach them job skills. Their credit scores have tanked, they said, so they cannot buy houses and cars. Several said they would like to get married, but don’t want to saddle their partner with their debt. And they can’t go back to a more reputable school, they said, because they are too deep in the hole already.

Hornes attended Corinthian’s Everest campus in Ontario Metro from 2010 to 2014, where he says he earned a business applied management degree and racked up $68,000 in debt. He now works at the fast-food restaurant Smashburger.

During a meeting with officials from the Education Department and the Consumer Financial Protection Bureau in Washington, D.C., Hornes and the other students said that if officials don’t reply to their demands in 30 days, they are prepared to come back with more disgruntled former students and press their case again.

“We know this is wrong and we’ll go wherever we need to to make sure this is fixed,” Tasha Courtright, 33, said.

Last summer, Corinthian was forced to close or sell off most of its campuses after the CFPB accused the company of falsifying job placement rates and pressuring students into taking out loans. Attorneys general in several states have filed lawsuits against Corinthian and several lawmakers have urged officials to consider discharging the students’ federal loans.

Courtright owes more than $41,000 after earning an associates degree in criminal justice and a bachelors in business management from the same Everest campus as Hornes. She now works just several hours per month as a substitute in an elementary school cafeteria.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-