These states will take away your driver's license if you default on student loans

Nurses and teachers across the country are at risk of losing their jobs if they default on student loans.

Nearly two dozen states have laws on the books that allow states to confiscate the driver’s licenses or professional credentials – real estate licenses, teaching credentials, nurse registrations, etc. – of people who have fallen behind on their student loan payments.

But there have been recent attempts by state lawmakers in several states to get rid of such laws, which are spelled out here by Jobs with Justice, which cites data from the National Consumer Law Center’s book, Student Loan Law.

Montana, Iowa and Oklahoma, states that aren’t exactly known for their superior public transit systems, confiscate driver’s licenses. Those same states, plus many more, including California, Florida and Texas, can prevent nurses and healthcare professionals from working if they fall into default on student loans.

Student advocates say the rules punish debtors in a way that makes no sense, by removing their ability to earn a livelihood, and thus their ability to repay their loans. Revoking driver’s licenses can also be debilitating, they say, in places where public transportation is limited and nonexistent.

“I think these policies are crazy,” Sarah Audelo, policy director for Generation Progress, the youth-focused arm of the left-leaning Center for American Progress, told Fusion. “We are talking about people who are struggling to pay back their loans and when you take away things like driver’s licenses, that’s how people get to work.”

Sarah Lovenheim of the student advocacy group Young Invincibles, said in an email to Fusion, “We should be making it easier for student borrowers to repay their loans, not harder. It’s appalling that student debt stunts our generation’s ability to live on our own, buy cars, homes, start families, and now even our drive to work.”

The groups have criticized the laws and pushed for policies that reduce expensive interest rates, but there has been little movement across states to repeal the laws.

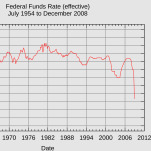

Some of the laws were put in place in the 1990s and early 2000s when default rates were at historic lows and there may have been a public perception that people who weren’t paying back were choosing not to repay loans, not that they couldn’t afford to repay them.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-