Trump’s Immigration Policies Are Creating a Lasting Drag on Jobs and the Economy

Photo by usicegov

The Dallas Federal Reserve is out with a compelling paper today suggesting that all the extremely tepid job growth this year that led Trump to fire the head of the Bureau of Labor Statistics then appoint an unqualified hack then withdraw said unqualified hack’s nomination is actually “a new labor market reality.” Our expectations of the jobs market may be rooted in a past that is never returning thanks to two factors: one that Trump has no control over, and another that is entirely of his creation.

Jobs numbers are difficult to interpret for many different reasons, but context for the layman is always the biggest. Are 89,000 jobs added in a month good or bad? It all depends on the experts’ expectations. If it occurred in the middle of a recession where analysts expected job loss, then that’s terrific news. If it occurred in the middle of a huge expansion, maybe that’s a sign the bubble is bursting. Analysts root their expectations in past data and the demand for jobs the economy creates, but the problem is that changes to demographics and immigration may have rendered pre-2024 data oranges when compared to today’s apples.

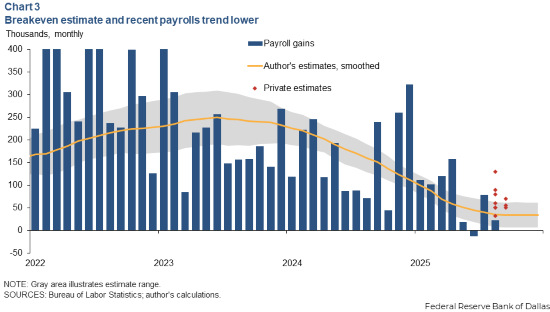

Chart by Dallas Fed

“Break-even employment is most commonly understood in two ways: It is the pace of job growth needed to hold the unemployment rate constant, or, equivalently, the growth required to absorb the net monthly increase in the size of the labor force,” wrote Anton Cheremukhin of the Dallas Fed. He used this key metric and others to dig deeper into the new dynamics of the American economy and labor force, and it unearthed some unsettling dynamics. Namely that all that job growth we interpreted as bad this year is actually meeting demand, as the above chart shows with the weak payroll gains around his estimate of the break-even unemployment rate at a tepid 30,000 new jobs per month.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-