The Stock Market Is Selling Its Soul and the Fed’s Independence to Trump Because ZIRP Broke The World

Photo by Kbh3rd

One of my most deeply held opinions about why everything is like this is zero interest rate policy (ZIRP). President Donald Trump could only be birthed from a distorted world where borrowing is free and future cash flows are infinite. Our modern era is defined by elite capitulation to Trump’s rank authoritarianism, and the stock market might be at the front of the line to do it. The bond market might argue it’s already there given how differently they are looking at the world. Both financial markets are telling two very different tales under Trump 2.0, as bond traders are perpetually nervous and getting yanked in multiple directions, while the stock market is flashing its unrealized gains and bragging to everyone that it has absolutely no principles nor long-term foresight and would happily burn the whole world to the ground just to return to 2011.

Trump is attempting to fire Fed Governor Lisa Cook, a thing he cannot do without cause. The cause he is trying to find is classic Trump bullshit, and America’s preeminent real estate fraudster who bankrupted six rigged businesses is all of a sudden concerned with supposed mortgage fraud. This is another instance proving how the rule-bound financial press is infinitely more well-equipped to deal with Trump than the pathetic stenographic political press, as CNBC properly frames this as an “effort” to fire Cook, while the New York Times wrongly portrays her illegal firing as already complete, and frames her legal challenge along the rules CNBC laid out as an “asserti[on] Trump abused power.” I don’t know who’s more hopeless at this point, shitcoin traders or New York Times editors.

An allegation of mortgage fraud is the patina of legality that Trump is wearing in his bid to fire a Black woman because a white man won’t follow his diktat to lower interest rates by three percent in one fell swoop, a move orders of magnitude larger than anything the Fed did in 2008. Trump probably looks at trying to fire an accomplished and qualified Black woman as an added bonus to his depravity, but the primary goal here is clearly to end the Fed’s independence once and for all. He’s been working at it all year.

And the stock market is slightly up today! There is some logic to this move because bond yields are down, some basic math I will get to later when I detail why ZIRP drove our society off the cliff, but the move in bonds isn’t so severe that stocks couldn’t have a bad day, and they have a very good reason to have a very bad day.

The Fed’s independence is sacrosanct. It is not hyperbolic whatsoever to say it is the keystone the entire global economy rests on. The Fed’s allegiance (allegedly) is to the well-being of the market and the broader economy. They give themselves inflation and employment mandates, and these metrics guide their decision-making that is akin to the moon’s effect on the tides. You may not see it directly, and it takes some time to really make an impact, but every gyration in the global economy has some level of Fed influence to it right down to your paycheck. The Fed does a lot more than just manage interest rate policy, but interest rates are at the core of their job because they are the price of money. The global economy looks to the Fed as the leader of global monetary policy, and if all of a sudden, the Fed’s mandate is Trump’s mandate, that upends the entire theoretical basis of the global economy. The Fed losing its independence to Donald fucking Trump’s whims is an economically apocalyptic event.

Speaking of economically apocalyptic events, let’s dive into the last part of my title, and take a trip back in time to 2008.

Money Should Cost Something!

ZIRP emerged from the 2008 crisis, and at the time, it made sense. Comically corrupt levels of mortgage fraud propped up the eternal housing bull market in America. Leading up to 2008, lenders became laughably lax in who they would lend to, because real demand for our housing market was not necessarily from those living in them, but for the financial players who were securitizing the mortgages and selling them through complex financial businesses. Chopping them up into tranches of increasing riskiness and awarding those who took the most risk first sounded nice in theory, but when fraud was the animating principle of the market, the difference between a AAA-rated security and a B-rated one may have been gifted day old sushi (RIP good Matt Taibbi journalism).

As soon as the music stopped in 2008 and everyone realized that no one knew what anything was worth, asset values tanked, and Lehman Brothers found out that they actually were running a bankrupt operation. Lenders going bust is never a good thing, because the people they owe money to have less money to pay the people they owe money to, etc…etc…etc…which is why the government is called the lender of last resort. The Troubled Asset Relief Program (TARP), passed by George W. Bush’s Congress, not Barack Obama’s as many on the left commonly get wrong, gave the banks a huge bailout because quite literally no one else would and without it the entire global economy would have melted down. In the wake of the largest crash since the Great Depression, the only way to get borrowing up and running again was to take the cost of borrowing as low as possible. Borrowing is vitally important to our world because that’s how you invest in the future.

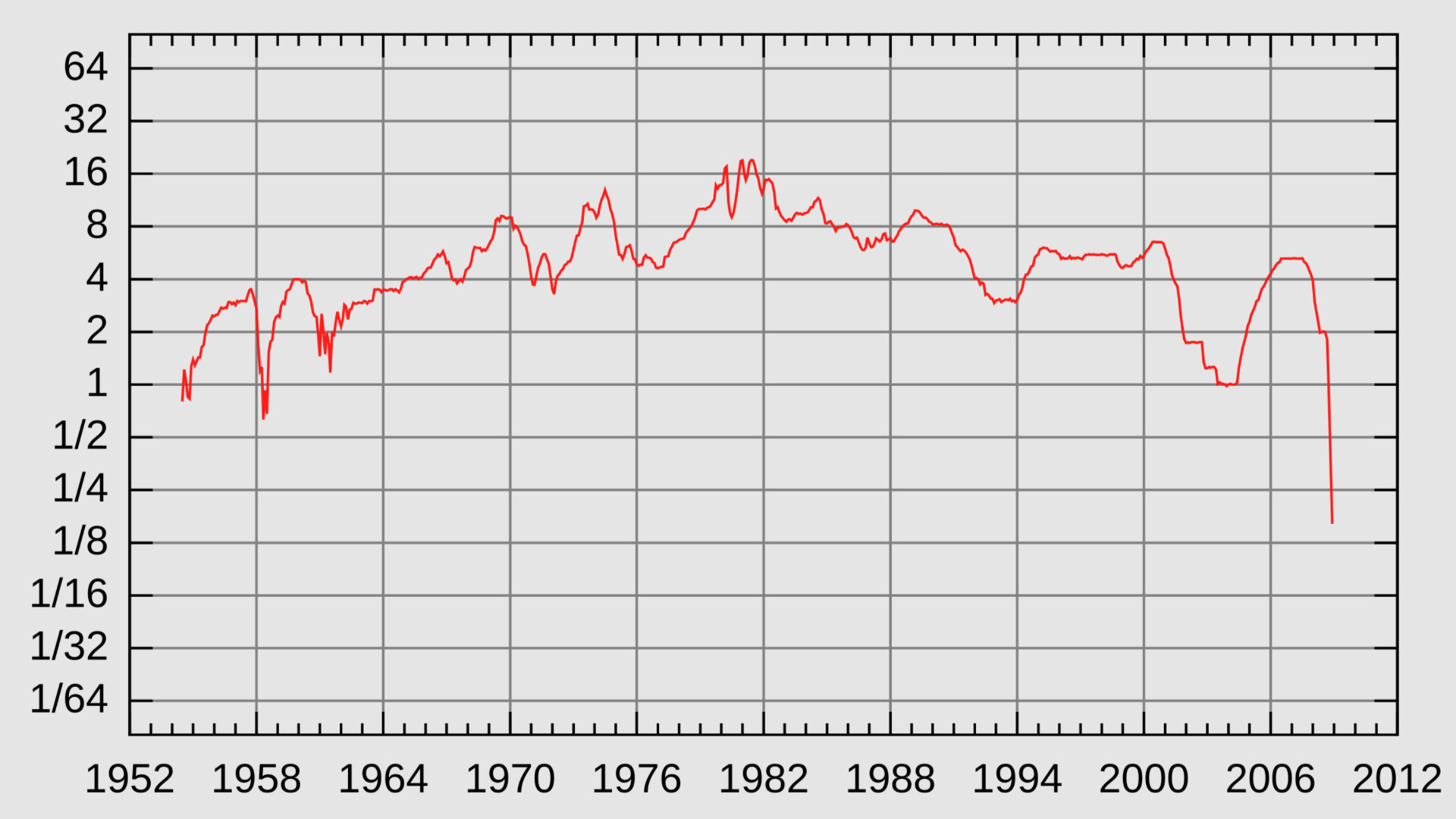

But like nearly all emergency powers, it was abused, and kept in place far longer than it ever should have been. ZIRP distorted the world, and created a set of unrealistic expectations around everything ranging from politicians to real estate to burrito taxis. I am always weary of introducing math into a block of text, but there is one very simple financial equation I think everyone should learn, because it will help you understand why Marc Andreessen’s head keeps getting pointier as he keeps getting angrier.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-