Trump Asks Supreme Court to Let Him Crash the Economy

Photo by Office of Senator Lindsey Graham

The most important thing to understand about the saga of Trump’s attempt to remove Federal Reserve Governor Lisa Cook is that this is not about Lisa Cook. This is about the most hallowed ideological construct in economics: the Fed’s independence. Monetary policy is boring, and no one should ever be forced to endure the horrors I did learning about interest rates and such, but it’s important that someone understands this madness, because the whole world runs on it. The now compromised Bureau of Labor Statistics releases data that the world and the Fed use, and it is assumed that we’re all looking at the same data and working towards the same ends of growing the economic pie. The Fed uses its own set of internal backwards-looking tools to set interest rates that often get criticized for being “too late,” as the president has branded Jerome Powell, the Fed Chair Trump openly said he was going to fire before his advisers undoubtedly showed him their simulations of the market meltdown that would ensue. President cancel culture has now pivoted to finding another way to wriggle through this set of defenses around the Fed to reach his true aim of setting interest rates himself.

So of course an accomplished Black woman would be his next target after accepting that he can’t chop the head off of the Fed’s snake without instantly crashing the markets, so he has to find a more subtle route in. He cannot legally fire Fed governors without cause, whether it’s Powell or Cook, because again, their independence is sacrosanct. This is why he’s throwing around allegations of mortgage fraud and buildings going over budget, a man who only traffics in fiction must find a fact to get what he wants.

It is something of an economic article of faith across the entire financial world that the Fed will adhere to its own dual mandate of maintaining healthy labor market and 2 percent inflation, and all assumptions made downstream of this powerful institution are made with the trust that it will operate according to this well-known mandate, and not to partisan political whims. I cannot stress enough how trust is the real thing that actually underpins finance, not money, and the industry’s obsession with pricing risk is effectively pricing trust. Without trust, the long-term investments Trump wants businesses to make in America will happen anywhere but America.

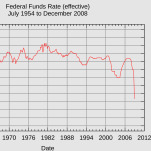

Trump wants to change the fundamental economic paradigm which built the world around us. He wants everyone to have to trust him, without realizing that other, potentially more trustworthy countries sell their debt too. Ever the real estate man, he is obsessed with interest rates, the true ZIRP god the delusional and most expensive stock market ever has earned for itself. All year, he’s been clamoring to cut 3 percent off the Fed Funds Rate in one meeting to get it down to 1 percent, a gargantuan single cut that is larger than the entirety of Fed cuts made in 2008 (2.92 percent). The Fed cut 0.25 percent yesterday (25 bps, or basis points, if you want to sound fancy to us finance folk), as they do want to eventually lower the Fed Funds Rate to around 2 percent where they deem that inflation will have officially been tamed. But monetary policy has long and lagging effects, which is why they prefer to move slowly at 25 or 50 bps at a time and wait to see what happens. If they’re moving 75 bps at a time like they did on the way up after the Fed was late in 2022, you know the shit has hit the fan to some degree. Trump wants a 300 bps cut yesterday. This is madness.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-