US GDP Growth Was Negative, and It’s Both Better and Worse than It Looks

Photo by The White House

Today was a big day for our economy, as first quarter Gross Domestic Product (GDP) was released, and the headline is very bad: US economic growth declined for the first time since 2022. Expectations were for a lukewarm 0.4 percent quarterly GDP growth, and it came in at negative 0.3 percent. This is simultaneously worse and better than it looks, as indicated by the stock market opening down over two percent on the news and closing slightly in the green (it also indicates how much stocks have become like crypto in how hopium-dependent they are and how much they are setting themselves up for Trump to pull the rug out from under them).

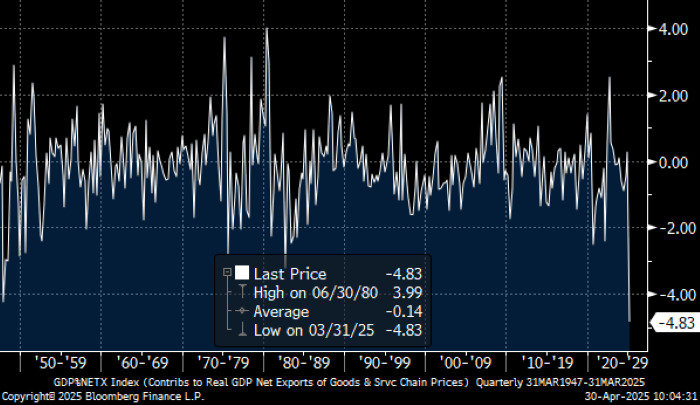

First, the good news. The negative GDP figure was entirely driven by Trump’s trade war. The engine of the American economy, consumption, grew by 1.8 percent, but net exports fell by nearly five percent, a staggering report, warping the topline GDP figure. The reason for this is simple: everything in our economy we buy from China has a 145 percent surcharge (at least) added to it because president deals thinks that 19th century economics is pretty cool. I bought some stuff I normally would not buy these past couple of months to try to get out ahead of everything becoming more expensive later in the year, and it’s crystal clear I was not the only one. The net export pullback is the largest in the historical record going back to 1947.

Chart via Bloomberg Terminal

This very predictable consumer behavior that anyone with a cursory understanding of the difference between big and small numbers and the nature of linear time could grasp is responsible for negative first quarter GDP, and the fact that GDP only contracted by 0.3 percent is “a relatively solid underlying report when it comes to demand” according to Shannon Grein, an economist at Wells Fargo. It sounds weird to say, but it’s true: this negative GDP print actually proved that the US economy was in pretty decent shape as of the end of March.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-