5 Things You Should Know About Janet Yellen

But who is Janet Yellen?

Here are five things you should know about about the 67-year-old woman set to succeed outgoing chairman Ben Bernanke.

1. She’s an academic

Yellen grew up in Brooklyn and attended Yale University, where she studied under the renowned economist James Tobin. She taught, alongside her husband, economist George Akerlof, at UC Berkeley. She began her stint at the Fed in the mid-1990s before serving in the mid-2000s as the president of the Federal Reserve Bank of San Francisco. She is the current vice chairwoman of the Federal Reserve.

2. She’s good at her job

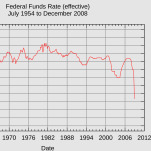

The Fed’s job is to regulate the American financial system, which in turn regulates the broader economy, by preventing it from becoming too big or too small. The Fed does this in part by raising and lowering interest rates. To slow the economy down, for instance, the Fed raises interest rates, which increases the cost of borrowing money.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-