Student Debt Bleeds Into Other Areas of Adult Life

Young people who graduate from college with student debt earn exactly what their debt-free peers earn: about $58,000.

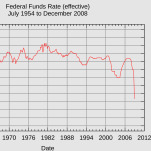

But according to a new report from the Pew Research Center, those student debtors are more likely to have credit card debt and car payments, and less likely to have a good nest egg, down the line. In other words, student debt, which eclipsed credit card debt in 2009 as the second largest type of debt owed by American families after mortgages, isn’t isolated. Its effects bleed into other areas of adult life.

While total debt – including things like mortgages, credit cards and car payments – has actually declined for young people over the last five years (in large part because they aren’t buying houses at nearly the rates their parents and grandparents did), it’s increased for people with student loans.

One potential explanation is that households burdened by student loan payments struggle to pay for other things like cars and housing without going into more debt. This makes sense. If you’re earning the same amount as your debt-free peers, but you’re already at a disadvantage by having to make student loan payments, you have less income left over and may go into other forms of debt. While just 11 percent of college-educated households without debt are underwater on their home, 21 percent of their peers with student debt are underwater.

But there’s another potential reason, Richard Fry, the report’s author, said, although he cautioned that both are speculation and require more research. Not only are more young adults pursuing college today than in the 1990s, the cohort pursuing college is increasingly diverse in terms of background. Today’s graduates come from a more diverse array of backgrounds than ever before, and some with a preference for student debt may also have a preference for other forms of debt, too, Fry said.

While a college degree significantly increases income, college-educated households with student debt earn what those without student debt earn – about $58,000. Same goes for households without a college degree, which earn about $32,000. The income gap between people who have a degree and people who do not is now wider than ever.

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-